The FMCG industry has changed drastically over the last decade. In the last 10 years, the revenue in the FMCG industry in India has been growing at the rate of 21.4%. As per studies, the FMCG industry in India is expected to grow at the rate of 27.9% CAGR (Compounded Annual Growth Rate) to sum to US$103.7 billion by 2020.

The key markets include:

- Increased awareness of online shopping

- Higher brand recognition and consciousness

- Constant change in consumer preference

The Covid-19 outbreak has impacted all the areas and the FMCG industry is no exception. With the trajectory of the virus undetermined, the situation remains volatile. Based on studies conducted and few data, we wanted to share with some trends that are likely to happen in the FMCG industry in the upcoming time.

Health care and personal hygiene products will continue to be in demand

Over the past years, people were already getting conscious of their fitness by joining gyms, doing personal exercise. However Covid-19 did fast-forward consumer focus towards eating more healthy food which can help in boosting their immunity.

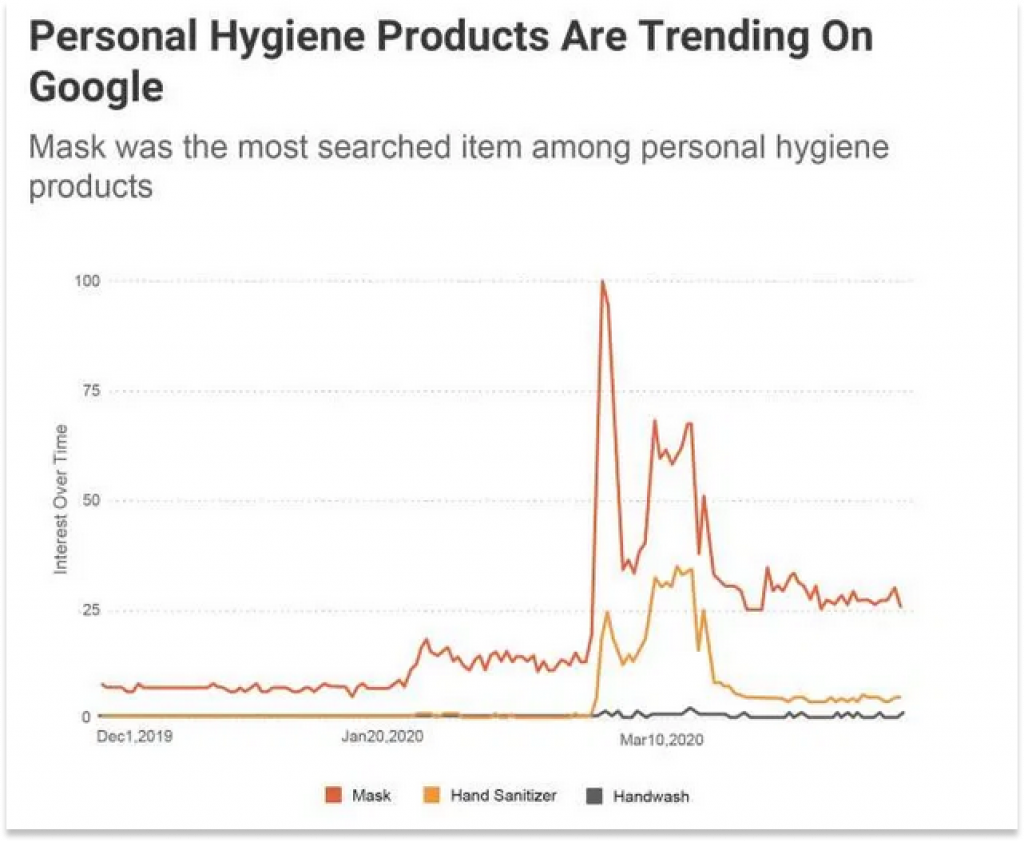

After the Covid-19 has emerged in India, there has been a surge in demand for products like hand sanitizers, hand-wash, disinfectants and other healthcare products. 55 percent of consumers intend to buy more personal hygiene and safety products. It has been observed that post Covid-19, there is almost a 400% surge in the demand for hand sanitizer and 120% surge in the demand for hand wash.

The personal hygiene market is expected to reach US $15 Bn by 2023 in India. Many brands are shifting their focus towards healthcare and personal hygiene products. Packaged consumer goods firm Dabur India has advanced the launch of an immunity-boosting health product given the new focus on preventive healthcare. Brands like Sugar-Free, Glucon-D are also planning to launch immunity-building products. Hindustan-Lever-United have been also concentrating their focus on this side.

Since March 2020, the google chart shows that there has been a tremendous increase in the searches for hand wash, hand sanitizer and mask. The trend is expected to continue even after the Covid-19, as the lockdown ends until the vaccine is widely available. Post Covid-19, the average sales of personal hygiene products will decrease but it will still be more than average sales of personal hygiene products before Covid-19 outbreak.

Future of Retail in O2O commerce

Studies show that the share of sales through e-commerce for the industry will increase from 2-3% before Covid to 4-5% post-Covid. The ecommerce sector is still only a fraction of the $1 Tn retail industry. This gap is shrinking and thanks to the coronavirus outbreak, even offline players are coming online now.

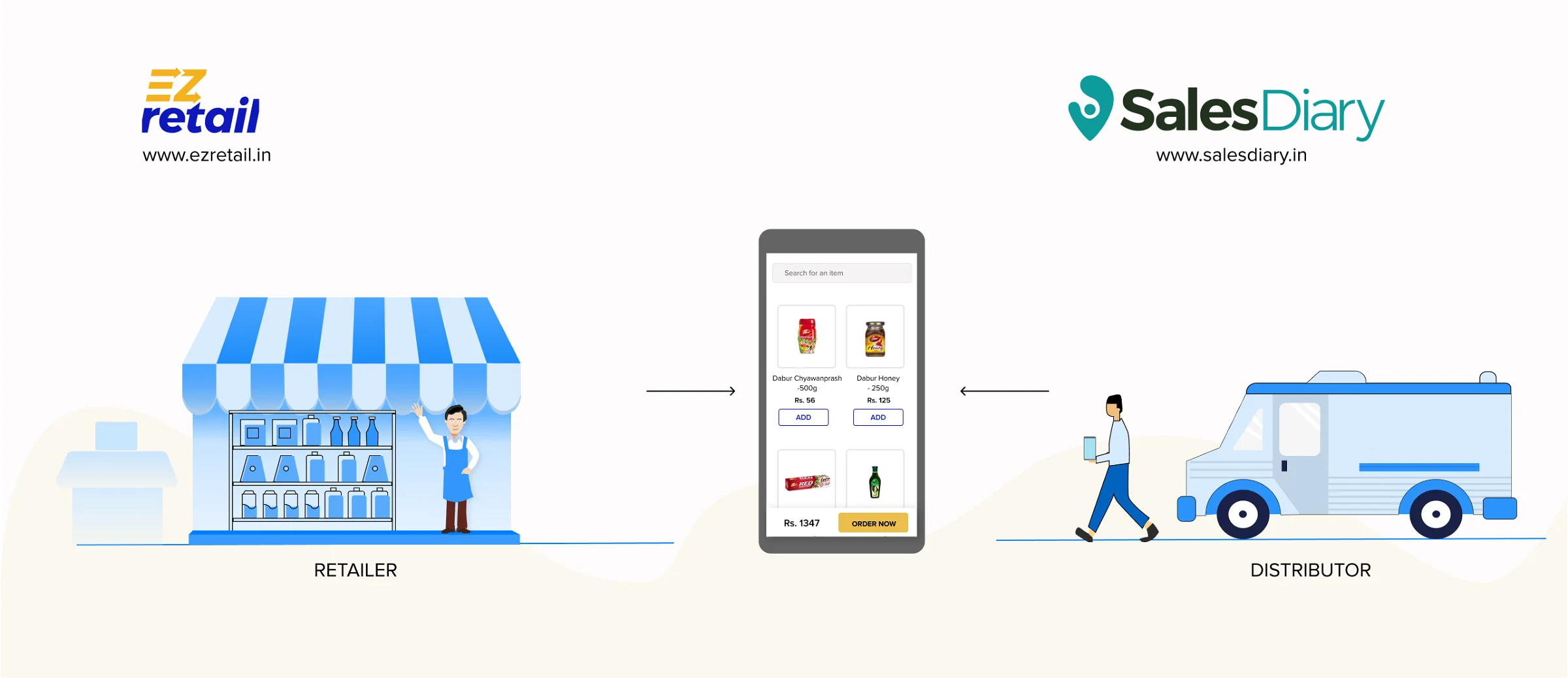

In the traditional method, Salesman used to visit retailers to take orders. Post Covid, Salesperson visits are severely hit but the market demand is high. So they are now placing orders through the Retailer app.

During Covid, Consumers’ in-store and online shopping habits are going to be changed. So, Retailers are adapting mobile technology at a faster pace to accommodate changing consumer behaviors and expectations. Brands are building online commerce and communities to continue their engagement with consumers during the outbreak. And for connecting Brands with their Retailers and Distributors, there are many B2B business models present today for example Udaan, ShopX, EZRetail and many more. These all companies are working in B2B space, but under different business models.

Unlike Udaan, while connecting with EZRetail app, Brands have two advantages – their supply chain model will remain unaffected and distributors will still be doing the supply and they can connect and engage with the retailers through announcements and loyalty points.

Focus on Digital Payments

After demonetization, people were trying to bring online payment like Paytm, UPI in their day to day life. Studies show that contactless and digital payments have grown 15x in the country over the last 18 to 20 months. Covid-19 has only expedited that trend. This pandemic has made it a necessity in their life. Groups who may have been hesitant to convert to online payments before COVID-19 now use it as their primary option. Things are going cashless so as to maintain social-distancing. Today, about 25% cards are contactless and about 15% of the transaction volume is coming from contactless cards.

Since FMCG Companies and Retailers are going online so mostly payment is also done online. Quick Response Code-based payments are gaining popularity in modern payment apps and devices.

The number of transactions via UPI continues to rise, hitting around 2 billion transactions.

When contactless transactions are being encouraged, people are opting for safe and easy digital payment modes and seeing the trend, people will get habituated to contactless payment and will likely continue to adapt this post Covid-19 also.

Rural-Consumption will pull-up

The annual FMCG consumption in rural areas is around $24 bn and is projected to reach $100 billion by 2025.

During Covid-19, around 40 millions of migrants in India have been migrated to rural areas. Restarting the Mahatma Gandhi National Rural Employment Guarantee Scheme, more commonly known as MGNREGA, a migrant worker exodus from cities and forecasts for a normal monsoon are increasing the appeal of staples stocks tied to rural India.

The central government has announced different relief packages for the farmers post Covid-19. As per studies, India’s farming market was worth INR 16,587 Billion in 2018 and was projected to reach INR 30,675 Billion by 2024, growing at a CAGR of 10.8% during 2019-2024. The relief package will give farmers the necessary support to get back on track.

In May, India’s Internet users have reached about 627 million. Of this, 293 million active users reside in urban India and 200 million active users in rural India. The rural internet users are growing by a whopping 35 percent annually in comparison to an urban user growth of 7 percent.

The internet penetration will help rural areas to create demand for more convenient shopping in the form of retail and e-commerce. This will result in increasing presence of retailers and e-commerce players in rural areas.

So government relief packages, mass migration, forecast of normal monsoon and internet penetration; these will likely increase rural consumption in upcoming years.

Renewed Strategies to accelerate business growth

FMCG companies are trying to adapt different strategies during Covid-19. They are running very tight ships at present. Automation at warehouses, Tie-ups with the online delivery platforms like Swiggy, Bigbasket, Dunzo, Partnering with logistic companies like Porter are the few strategies that Companies are focusing on. In April, BigBasket said 283,000 orders a day are being met, up from 150,000 before the shutdown, while Grofers said it was servicing 190,000 daily orders against 100,000 before the crisis.

Strong focus on cost control has become an important norm. Judicial advertising and effective use of digital marketing are playing a huge role in saving costs as well as improving outcomes.

Covid-19 is resulting in the emergence of a number of companies who are looking forward to connecting with brands and taking ownership of the local markets.